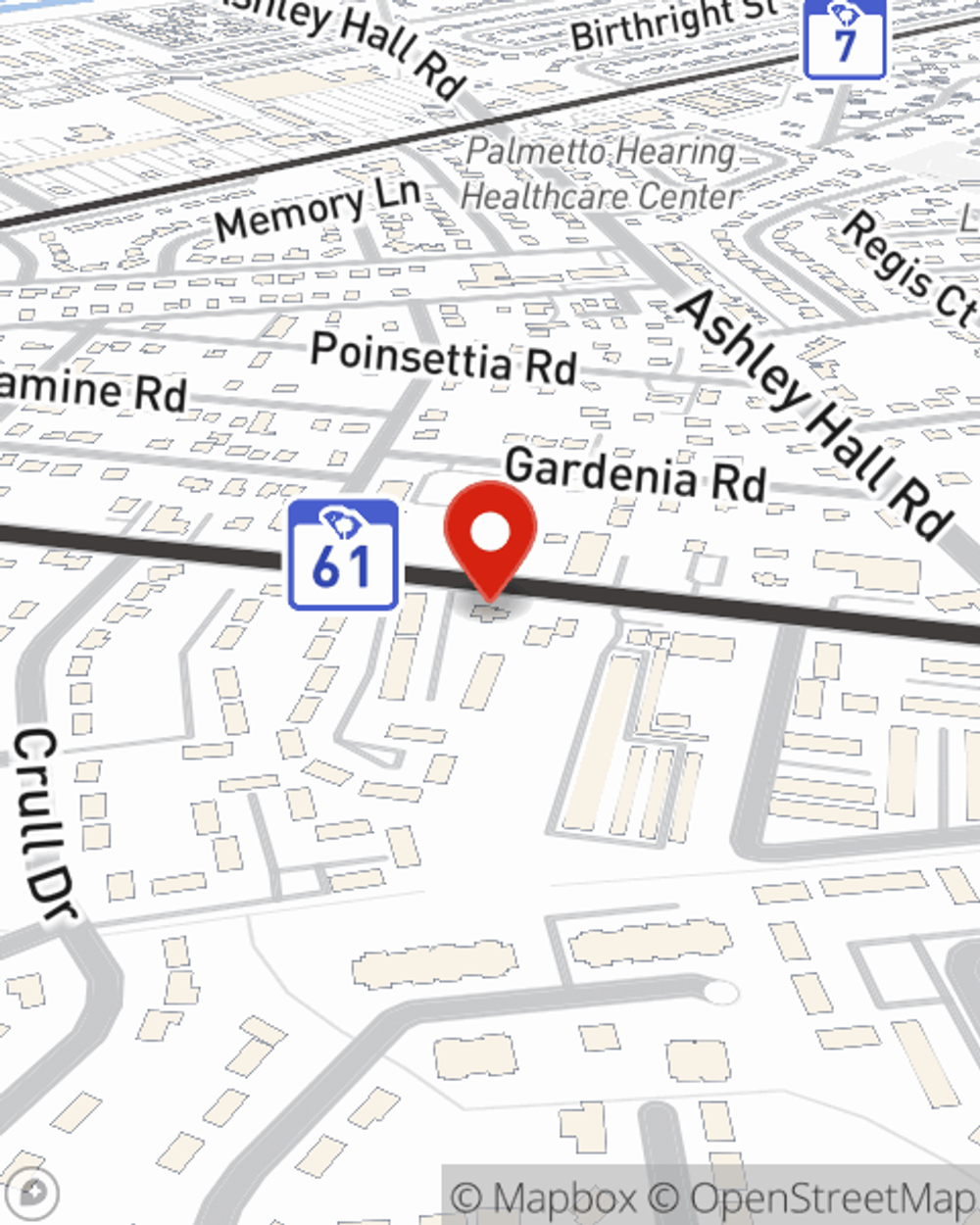

Business Insurance in and around Charleston

One of the top small business insurance companies in Charleston, and beyond.

Helping insure small businesses since 1935

- Charleston

- West Ashley

- Johns Island

- James Island

- Daniel Island

- Awendaw

- Myrtle Beach

- Pawley's Island

- Summerville

- Ladson

- Mt Pleasant

- Goose Creek

- Murrell's Inlet

- Charleston County

- Berkeley County

- Dorchester County

- Hollywood

- Ravenel

- Ridgeville

- North Myrtle Beach

- Surfside Beach

- Garden City

State Farm Understands Small Businesses.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like business continuity plans, a surety or fidelity bond and worker's compensation for your employees, you can feel secure knowing that your small business is properly protected.

One of the top small business insurance companies in Charleston, and beyond.

Helping insure small businesses since 1935

Protect Your Future With State Farm

Whether you own a donut shop, a pizza parlor or a HVAC company, State Farm is here to help. Aside from excellent service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Ready to discuss the business insurance options that may be right for you? Get in touch with agent Heather Eberlin's office to get started!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Heather Eberlin

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.